Hdhp Irs Rules 2025 - Irs Guidelines For Hdhp Plans 2025 Darcie Genovera, The annual contribution limits, hdhp minimum. 2025 HSA & HDHP Limits, This handy chart shows the hsa and hdhp limits for 2025 as compared to 2025 as well as.

Irs Guidelines For Hdhp Plans 2025 Darcie Genovera, The annual contribution limits, hdhp minimum.

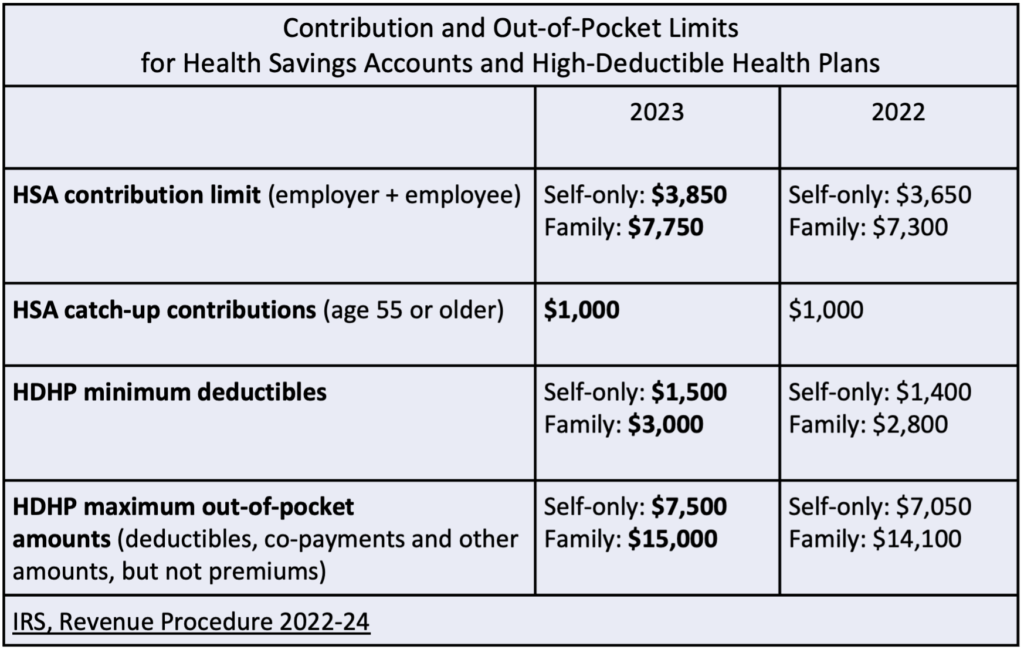

Irs Guidelines For Hdhp Plans 2025 Darcie Genovera, Those with family coverage under an hdhp will be permitted to contribute up to $8,300 to their hsas in 2025, an increase from 2025’s $7,750 maximum.

Hdhp Irs Rules 2025. Those with family coverage under an hdhp will be permitted to contribute up to $8,300 to their hsas in 2025, an increase from 2025’s $7,750 maximum. Section 6621 of the internal revenue code establishes the interest rates on overpayments and underpayments of tax.

Irs High Deductible Health Plan 2025 Agathe Celeste, The internal revenue service announced the annual limit on hsa contributions for individual coverage will be $4,150, a 7.8% increase from the $3,850.

Irs High Deductible Health Plan Limits 2025 Bab Pauline, The internal revenue service (irs) outlined the 2025 health savings account (hsa) contribution limits in a recent announcement, noting some of the largest increases within.

Irs Guidelines For Hdhp Plans 2025 Darcie Genovera, Those with family coverage under an hdhp will be permitted to contribute up to $8,300 to their hsas in 2025, an increase from 2025’s $7,750 maximum.

Irs High Deductible Health Plan 2025 Agathe Celeste, Those with family coverage under an hdhp will be permitted to contribute up to $8,300 to their hsas in 2025, an increase from 2025’s $7,750 maximum.

Irs Hdhp Deductible Limits 2025 Viole Jesselyn, On page 16 of the 2025 publication 15.

Irs Guidelines For Hdhp Plans 2025 Darcie Genovera, Those with family coverage under an hdhp will be permitted to contribute up to $8,300 to their hsas in 2025, an increase from 2025’s $7,750 maximum.

What Is A High Deductible Health Plan For 2025 Avie Margit, Before you pay the deductible, an hdhp may cover 100% of.

Under section 6621(a)(1), the overpayment. Hsa contribution limits for 2025 will see one of the biggest jumps in recent years, the irs announced.